The Payments Disruption Game: From Wallets to RTP to CBDC

The Low-Tech Merchant Payment Disruption

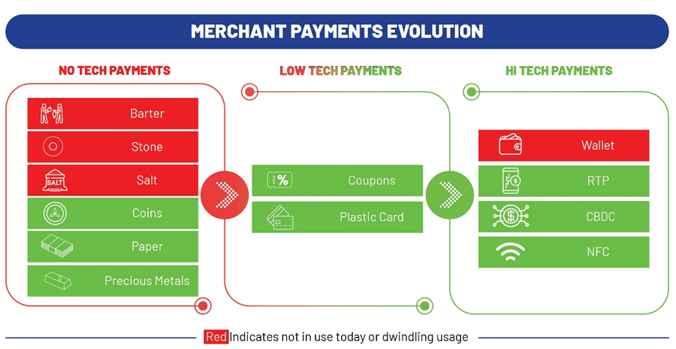

Merchant acquiring solutions have witnessed significant transformations over the past few decades, led by a diverse array of acquirers, including financial institutions and retailers. Rather than delving into an exhaustive historical account of payment evolution from barter systems to coins and notes, I'll fast-forward to the pivotal "card" based acquiring era. In this era, the innovative utilization of technology brought about a revolutionary shift in merchant payment methods, primarily through the introduction of plastic cards.

Transition from Low Tech POS to Hi Tech EDC

The primary consideration for merchants and their service providers when designing payment acceptance solutions has always been the convenience of consumers. In more advanced markets such as Europe and the United States, the 1970s saw the introduction of ZipZap point of sale (POS) systems. These systems were used to capture the embossed card details from a credit card onto a paper slip, often referred to as a "charge slip," using carbon paper. These charge slips were later processed by the bank to charge/debit the customer's credit card. However, this method was not only cumbersome but also prone to fraud.

In the following decades, spanning the 1980s and 1990s, the industry underwent a significant transition. Electronic data capture terminals (EDC) replaced the outdated system, offering a more efficient and secure way of processing payments. This evolution continued, and the industry eventually shifted to Electronic Point of Sale (EPOS) systems, integrating billing for even greater convenience.

Over the course of three decades, EDCs have remained a dominant force. However, within the EDC landscape, significant changes have occurred, with a transition from standard dial-up terminals to 3G-enabled devices and, more recently, to Android-based touchscreen machines.

The rise of e-commerce in the digital age began to reduce the necessity of having EDC terminals for purchases. Nonetheless, the credit card and debit card remained a fundamental form of payment instrument, ensuring that merchant payments, particularly in physical stores, were largely unaffected by this shift in consumer behavior.

Entry of the Hi-Tech Payments Era: Increasing use of Digital Wallets & Smartphones

The payment industry has witnessed more innovation in the past decade than it did in the entire previous century. The merchant payment segment wasn’t an exception. A notable shift away from the traditional card-based infrastructure for merchant payments occurred with the rapid emergence of prepaid digital wallets offered by major players like Google, Apple, PayPal, Alibaba, WeChat, and others. This transformation took place in a remarkably short period.

This period also marked the rise of the smartphone as the preferred device for initiating payments, even though mobile phones had been utilized for a very long time for peer-to-peer payments within closed-loop private networks like M-Pesa and Airtel Money, particularly in African markets.

While many, if not all, merchant wallets, including issuer-led wallets, encountered a common challenge — the "acceptance boundary." Most of these wallets were either non-interoperable or only operated within specific, closed-loop ecosystems. Typically, retail consumers adopted these wallets primarily if they were frequent users of specific merchant services, as exemplified by Google Wallet. Although issuer-led wallets made sincere efforts to establish acceptance infrastructure, they were unable to match the reach and flexibility of card-based infrastructure. As a result, consumers continued to rely on cards for various types of merchant payments, driven by the cards' widespread acceptance and assurance of interoperability.

A Red- Card shown to Wallets: A New Player Emerges

Consumers liked frictionless CX. Wallets were a brainchild of entrepreneurs. Realtime payments was a similar idea but by governments and at scale. No surprises as to who wins. Although digital wallet saw high initial adoption; it experienced a rapid decline over the years. In my view, the primary reason for this decline was that wallets, whether merchant or issuer-based, struggled to establish credible and assured interoperable acceptance. Customers, often had to carefully select the right wallet at each merchant location and ensure they had a sufficient balance before use. On the flip side, merchant checkout counters were cluttered with multiple QR codes, complicating the user experience.

Note: QR images are for generic representation purposes only.

In my opinion, the wallet ecosystem faced this limitation due to the absence of a governing interchange system akin to international card associations like Visa and Mastercard in the card world. Instead of replacing one physical cash wallet, consumers ended up with multiple digital wallets on their mobile devices. While customers appreciated the user experience of wallet-based payments, the following few issues added friction to the overall CX

(a) Requirement of top-up from bank account or card.

(b) Inability to use balance till least denominator.

(c) KYC needs regulation imposed by regulators.

(d) General cap on transaction limits especially non-KYC wallets.

To maintain "consumer stickiness," wallet issuers had to continuously invest in incentive programs such as discounts, cashback, and coupons to retain customers and encourage usage. However, wallets did significantly alter consumer habits, especially among the younger generation.

Launch of real-time payment (RTP) networks nearly killed wallet ecosystem in many countries RTP not only provided a customer experience comparable to digital wallets but also eliminated several wallet limitations mentioned above. I would still want to list some of the winning differentiators of RTP over wallets including,

(a) Direct to bank account – no need to top-up.

(b) No additional KYC – Tagged with bank account.

(c) Enhanced transaction limits.

(d) Many more products compared to wallets such as recurring payments, direct debit etc.

The critical “winning” factor was “guaranteed interoperability” similar to card networks. As a consumer, you could have an account with any bank and still scan an RTP QR at any merchant location nationwide without worrying about the merchant's bank.

RTP posed a significant challenge to proprietary wallet-based acquiring and has effectively replaced them in multiple countries within just a couple of years.

The Acquirer’s Dilemma: Rapidly changing Goalposts

Let's examine the scenario from the perspective of merchant acquirers. Initially, the rapid expansion of real-time payment (RTP) based merchant acquiring caught many by surprise. Consequently, most acquirers adapted their existing peer-to-peer (P2P) payment engines to connect to the RTP network, leading to customizations in existing merchant management and back-office systems. As an acquirer, this “shortcut” resulted in the presence of multiple technological platforms: one for card-based merchants, a second for RTP-based merchants, and the potential need to build another for Central Bank Digital Currency (CBDC) based acquiring, and so forth. Efforts invested in building wallet acceptance infrastructure began to appear redundant.

Card payments follow a "pull" payment model with a synchronous flow of initiation, validation, approval, merchant confirmation, and consumer confirmation. In contrast, RTP is a "push" type payment initiated by the customer. The initiation, validation, and approval processes occur in the issuer's domain, giving the merchant less control. Consequently, RTP-based acquiring initially started with simple QR code standees and SMS-based or in-app notifications. While this worked for smaller, standalone merchants, larger retailers soon required QR codes to be displayed on point-of-sale (POS) systems and printed receipts, mimicking the card transaction process for customer comfort.

Adding to the complexity, various “new” segments of merchants, such as family-run shops, entered the acquiring ecosystem at their own pace. These merchants retained their "cash-only" status but joined electronic acquiring due to attractive “schemes” such as zero Merchant Discount Rate (MDR) on small transactions. To cater to this segment, acquirers had to offer unique solutions, such as QR standees with voice prompts, leading to additional technical requirements. Merchant back offices had to undergo continuous changes to improve efficiency and introduce new features, including:

(a) Implementing self-enrollment for small merchants, as it was not cost-ineffective to send correspondents to acquire them, while still wanting them to be part of the program.

(b) Adapting to changes in MDR and fee rules dictated by network operators, often driven by regulators. This ranged from the initial zero MDR to floor-limit-based fees and the concept of allowing convenience fees instead of MDR, among other alterations. The industry is expected to keep innovating as new ideas emerge.

(c) Real-time payments offer a distinct advantage over card networks in terms of multiple or even instant settlement. Acquirers do not need to wait for T+1 settlement, and merchants can technically request instant settlement for high-value transactions by paying a higher MDR. However, many merchant settlement systems are based on the T+1 concept from card transactions, making the acceptance of such requests a challenge.

(d) Acquirers continued to innovate and explore revenue-generating ideas by frequently modifying transaction fees, convenience fees, and percentage-based MDR based on certain conditions, taking advantage of the flexibility offered by the RTP network.

Where the Game turns into the Olympics

RTP's global expansion is no longer a mere fairytale; numerous countries are already engaging in bilateral efforts. Cross-border P2P payments via RTP have already commenced, and pilot programs for cross-border merchant payments are underway in select ASEAN countries. While the scale remains modest today, the day may not be distant when customers opt to scan QR codes at international merchant locations or use CBDC wallets instead of swiping cards. This prompts the question of how acquirers can adapt to such rapid changes.

Will the existing acquiring systems, which have inherited the DNA of card-based payments, suffice for these new demands? Should acquirers persist in refining their legacy platforms, or should they explore the development of bespoke solutions as the market evolves, or even consider migrating to entirely new, agile, and modern platforms? The timing of investments in new platforms to future-proof acquiring systems is a pressing issue under ongoing debate.

Visa and MasterCard did a fabulous job of reducing friction in international payments. They will try very hard to protect their turf.

However, the prevailing reality is that customers are actively making choices, shifting from cards to alternative payment methods for their purchases, and this shift is expected to continue and grow rapidly. Emerging products such as recurring payments, credit on RTP rails, and offline or NFC-style wallets are creating viable alternatives to traditional cards. The attraction of relatively lower Merchant Discount Rates (MDR) is proving enticing for merchants, indicating the potential for further growth due to their increasing favorability. Exciting times lie ahead, with a strong need for a thorough reassessment of the current acquiring payments platform's ability to withstand the dynamic changes in the merchant acquiring space moving forward. The payments game continues…..

Upgrade to Next-Gen Payments Technology

The rapid evolution of payment technology demands forward-thinking strategies. Our guide offers detailed insights to help you modernize your systems and keep pace with industry advancements. Prepare for the future—download your guide today!

Read More About:

Card Issuing

Switching

ATM Management

Payment Platform

Dynamic Currency Conversion

Payment Hub

Real-Time Payments

Comments