Revolutionizing ATM Cash Withdrawals in India

Discover How India's UPI Payments System is Revolutionizing Cardless Cash Withdrawal Technology!

India is assuming the role of a global leader in payments thanks to its constant innovations, as the industry is always evolving. The Unified Payment Interface (UPI), its real time payment system, is a great success story and a brilliant illustration of these advancements. Yet UPI isn't the only one affected. The National Payments Council of India (NPCI) has introduced a new product called Interoperable Cardless Cash Withdrawal (ICCW), based on the UPI ecosystem.

Numerous top Indian Banks, such as ICICI and HDFC, already have their own cardless cash withdrawal system in place. However, as it is a bank-specific solution, it can only be used with on-site ATMs. To put it simply, ICCW is a universal solution that enables customers to choose to make cardless cash withdrawals interoperable i.e. from any bank's ATM.

According to NPCI guidelines, the current ICCW withdrawal limit is INR 10,000/-(~US$120) per transaction. The implementation of this is still in its early stages, and not all banks have done so yet. The NPCI website states that about 15 Banks have implemented ICCW issuers live. Nevertheless, as of now there are only two Banks that offer acquirer services. However, this ought to be supported on most ATMs in the nation soon.

Once it is fully operational, this will save a lot of hassle with cash withdrawals because customers will not have to carry their debit card, and there is no need to remember their debit card PIN since UPI PIN will work for ICCW withdrawal as well.

More than convenience, it’s the safety that this solution brings to the customer. ICCW, being a contactless transaction, provides a safer transaction experience. Since a customer is not using his card on the terminal, there is no risk of card related fraud, like a card being cloned using skimmer devices on ATMs or stealing card PIN.

As of now, this is only implemented in India, as it needs NFS integration. But in the future, this might get implemented in all the UPI-participating countries.

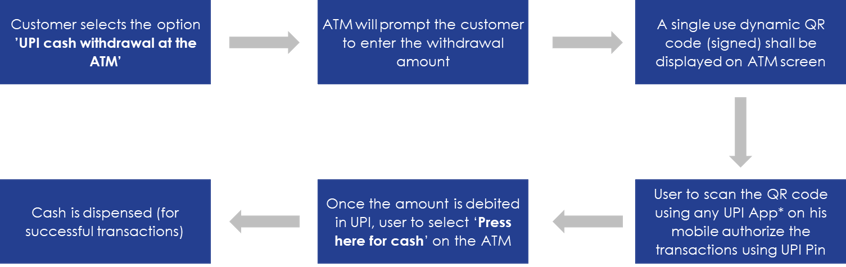

Below is an illustration of typical ICCW user journey (courtesy NCPI website):

The user journey of ICCW is quite similar to a P2P/P2M QR-based UPI transaction. UPI QR transactions typically involve a customer scanning a merchant's QR code and the amount is deducted from the customer's account and credited to the merchant's account.

Upon completion of the transaction and receiving notification of successful credit, the merchant hands over the goods to the customer. To add some context, ICCW is pretty much akin to this process.

The ATM terminal assumes the role of a retailer in this instance. Similar to a merchant, an ATM shows the QR code. To complete the payment, the customer scans the QR code. The amount is credited to Terminal's bank account and deducted from the customer's account. When finished, the ATM gives the consumer their money. It does look similar. right? However, it is more complicated than a typical P2M or P2P transaction behind the scenes. Not claiming that a typical UPI transaction is easy, but using an ATM terminal does add a layer of complexity of its own.

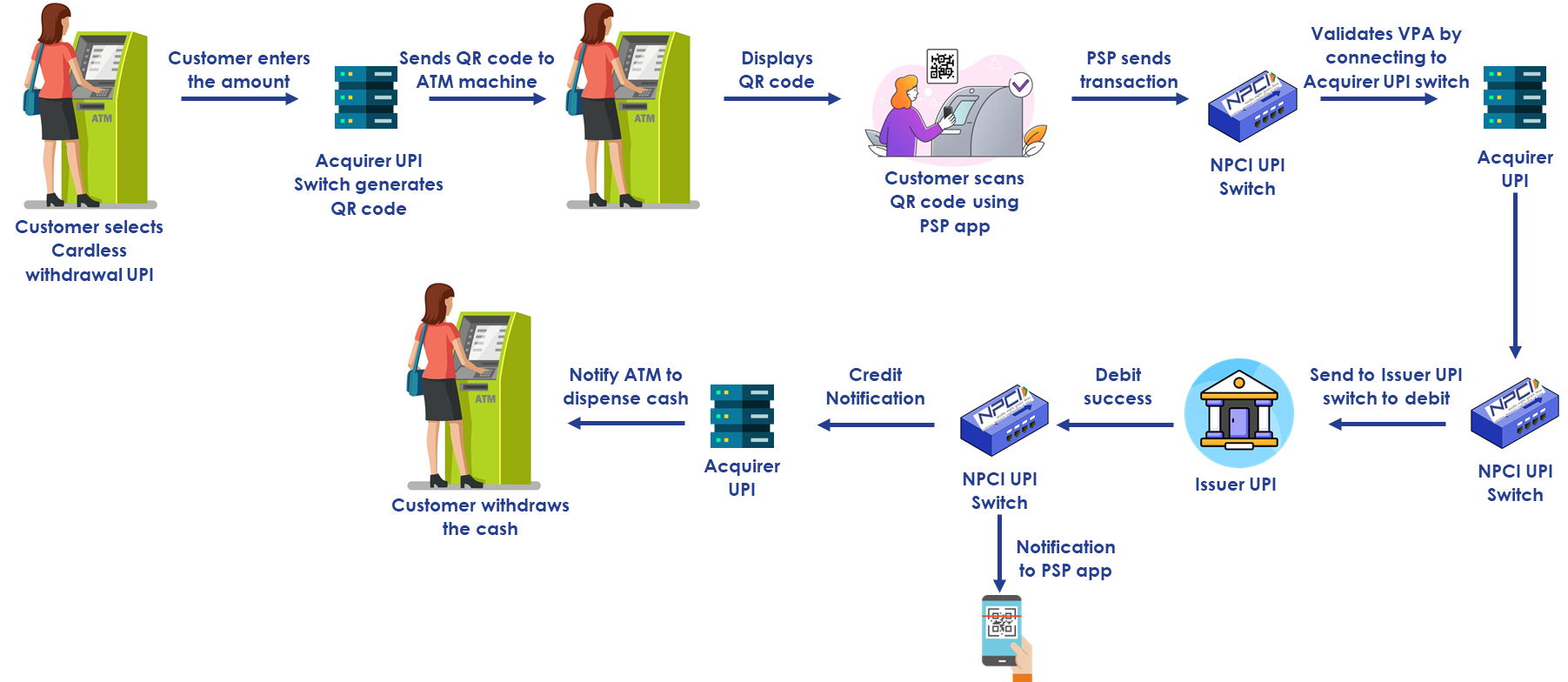

There are multiple parties involved in the payment processing process when it comes to a typical P2P or P2M transaction. The Payment Service Provider, or PSP, is the first one. It could be any third-party app, like GooglePay, PhonePe, PayTM, or it could be a mobile app from a bank. Next up are the NPCI UPI switch, the merchant's bank UPI switch, and the customer's Bank UPI switch. The processing of ICCW involves three more parties: ATM switch, NFS (the national ATM network), and OEM vendors (such as Hitachi, OKI, and others). Furthermore, included in the overall picture are terminal solution vendors like NCR, who offer middleware services to link terminals with acquirer UPI switches so that terminals can receive QR code.

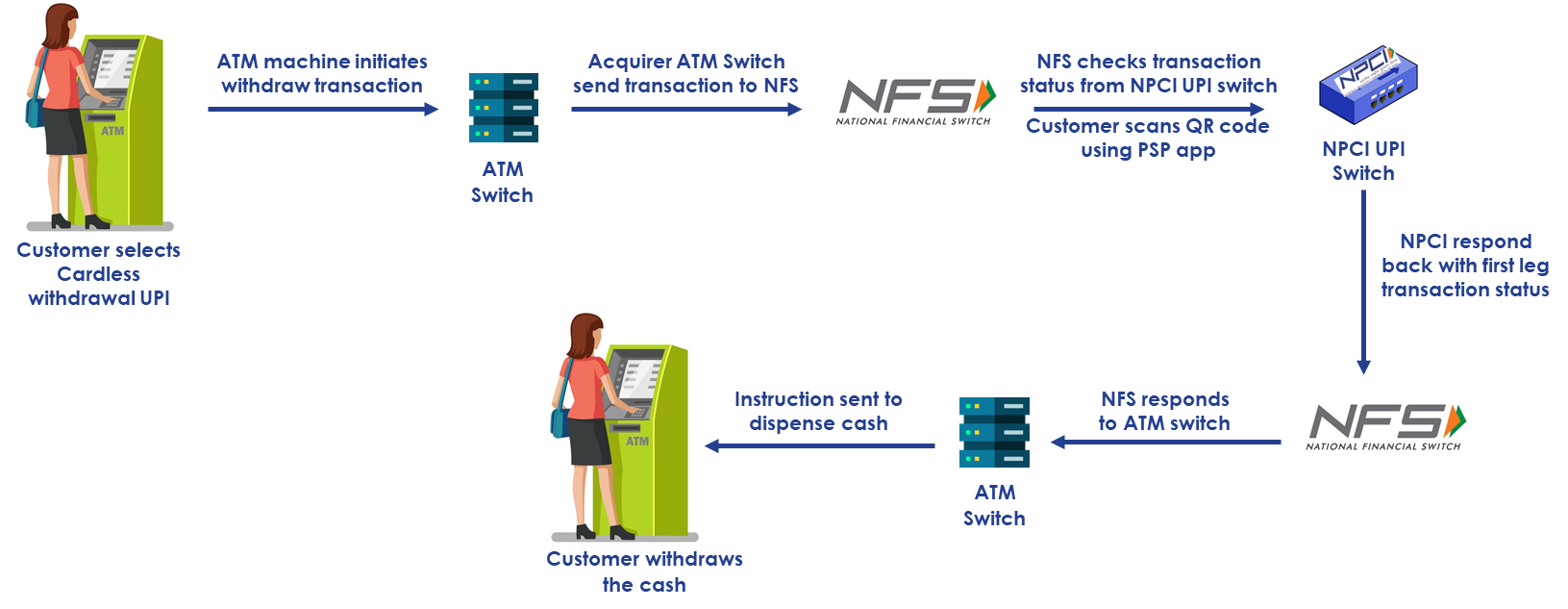

In contrast to P2P/P2M UPI, which is a single-leg transaction, ICCW is a two-leg transaction. The first leg of ICCW works similarly to UPI P2P/P2M in that the consumer uses his PSP app to scan the QR code on the ATM to start the first leg. Amount is credited to ATM's account and deducted from customer's account. Once that is done, UPI acquirer switch instructs terminal to initiate second leg which involves ATM switch routing the transaction to NFS. In order to verify the status of the first leg, NFS establishes a connection with NPCI UPI. If successful, the ATM switch receives a confirmation from NFS and issues an instruction to the terminal to disburse cash.

Below is an illustration of ICCW first leg:

Once ATM displays QR code, customer scans it and initiates UPI transaction. Below is the illustration of UPI transaction which happens behind the scene.

Customer gets notification on his mobile app of successful debit. Based on notification from Acquirer UPI switch, terminal initiates second leg.

This is how the ICCW transaction flows at a high level. Since NFS settlement is also involved, there are a lot of complexities in the processing, reconciliation, and settlement, which make it more complicated than typical P2P/P2M UPI transactions. There are many scenarios involving time-outs, customer pressing “Cancel”, or first leg is successful, but second leg gets timed out etc.

For ICCW, a reversal is not yet enabled and will be included in the second phase. As consequently, any terminal faults or timeouts that prevent cash from being disbursed for any reason are now a part of the reconciliation process. Reversals will, however, also be put into effect shortly, which will streamline the procedure for banks. As a result, in the upcoming months, we can anticipate many more additions and improvements to ICCW.

Every other day, new breakthroughs in the payments industry emerge, and as demonstrated by ICCW and UPI, one innovation leads to the next. This means that financial institutions must have the technology necessary to support this rapidly changing industry and be flexible. At Euronet, we are thrilled to be a part of this amazing adventure and proud of the impact our highly configurable, modern payments platform, Ren, is making. It is built with cutting-edge technologies. Ren has been designed to be microservices based, highly adaptable and simple to integrate new features and products.

Just like the life cycle of any other product, that of ICCW has just begun. Before it arrives at its ultimate destination, there will likely be a lot more flag posts along the route. However, will that be the end point, or will it just be the beginning of an even more of eventful journey?

Upgrade to Next-Gen Payments Technology

The rapid evolution of payment technology demands forward-thinking strategies. Our guide offers detailed insights to help you modernize your systems and keep pace with industry advancements. Prepare for the future—download your guide today!

Read More About:

Card Issuing

Switching

ATM Management

Payment Platform

Dynamic Currency Conversion

Payment Hub

Real-Time Payments

Comments