What are Real Time Payments?

What are real-time or instant payments and why do banks need it now?

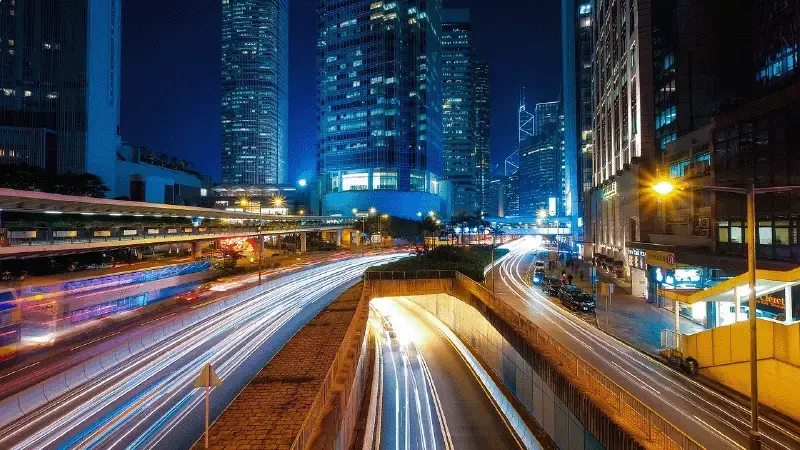

Real-time payments have revolutionized the way banks and other financial institutions conduct transactions. In today's fast-paced world, customers expect instant gratification and real-time payments provide just that. Simply put, real-time payments allow for instant transfer of money between bank accounts without the traditional lag of reconciliation of funds on either side of the transactions -- common in wire transfers, but also in payments to billers, creditors, and vendors.

Real-time payments work by enabling funds to be transferred instantly between bank accounts, typically using electronic payment networks. Real-time or instant payments make it convenient for customers to send and receive money at any time of the day, delivering instant access to funds and instant reconciliation of payments to ensure the most current accounting for any bank, business or individual.

Living the history of real-time payments

While instant payments are relatively new to the U.S. market, in truth, real-time payment networks have been a staple outside the U.S. for many years. The first real-time payment network was introduced in Japan in 1973 and many other countries soon followed suit, with billions of transactions flowing through real-time systems across many different use cases. Today, there are 79 countries with a real-time payment scheme in production.

With the launch of The Clearing House’s RTP network in 2017 and the availability of the Federal Reserve’s Fednow system in 2023, U.S. financial institutions can now provide their customers with instant money movement and settlement, delivering many benefits and driving deeper customer satisfaction.

Modernizing Complex Payments Technology

While real-time payment networks are available today, connecting a bank’s legacy payment technology to these networks has been easier said than done. U.S. financial institutions continue to lag in implementing real-time payments as a customer offering, given the perceived technological, financial, and security fears of replacing or modernizing legacy tech to catch the instant payments wave.

According to the article, FedNow draws some banks, as others lag, speaking specifically on FedNow adoption to date in the US:

“There are nearly 10,000 banks and credit unions across the country, so the bulk of them are not on board. And of the ones that have connected, many are only receiving payments and haven’t set up their systems to send payments.”

Also, from a recent Accenture commercial payments survey, six out of 10 banking and payments executives across all markets agreed that their organization struggles with the slow provisioning of new payment solutions due to a legacy tech stack.

Instant payments have become a customer expectation, so even bank leaders with concerns about cost, speed to market, process optimization, and data security are re-examining the case for why providing instant payments is critical for their long-term success.

Forward-thinking financial institutions are overcoming these challenges by leveraging cloud-based applications, silo-busting data connections via Application Programming Interfaces (APIs), and expanding messaging formats like ISO 20022 to bring legacy technology into the modern payments landscape.

Why do financial institutions need to offer real-time payments right now?

Answer: Your customers expect it and will move to another bank or a payments application company and avoid banks altogether if they can’t get it. According to a Federal Reserve study, approximately 70% of retail customers consider faster or instant payments an important satisfaction driver. On the commercial side, a survey from The Clearing House showed that 69% of large businesses are currently adding or plan to add instant payment capabilities in the next 12 months

Here's why leading financial institutions are offering real-time payments now:

- Customers expect to pay and get paid in real-time based on the ‘instant’ world they live in now. This real-time experience enhances customer loyalty and retention, as well as attracting new customers who value the speed and convenience of instant payments. Those businesses that provide this type of service get to keep their customers. Those who don’t run the risk of losing them.

- Swift adoption of instant payments now gives financial institutions a competitive advantage over their most common competitors. As an example, Euronet, with its Ren Payments Hub, not only creates a high-speed onramp to real-time payments but a comprehensive platform for accessing all instant payment networks, robust wire transfer solutions, and seamless ACH payment management.

- Real-time payment technology streamlines operations by reducing the need for manual processing and reconciliation. Financial institutions offering instant payments see significant decreases in the cost of manual errors and fraud as a result. According to McKinsey, the modernization of payments tech can reduce operating costs by 20 to 30 percent and can halve the time needed to market new products.

OK, but more specifically, what does a business customer of a bank get out of a provider of real-time payments?

Business customers prefer real-time payments providers because:

- Real-time payments enable businesses to receive funds instantly, improving cash flow management through immediate fund access to cover operational expenses, investments and other capital expenditures.

- Real-time payments offer faster settlement times compared to traditional payment methods like checks or ACH transfers. This speed accelerates the flow of funds between business partners, suppliers, and customers, enabling quicker transaction cycles.

- Businesses can automate payment workflows, saving time and resources that can be allocated to more strategic initiatives.

- Real-time payments offer enhanced security features and real-time fraud detection capabilities, reducing the risk of fraudulent transactions. This helps businesses safeguard their finances and protect against potential losses.

The benefits of implementing instant payments are clear:

Improved customer satisfaction, reduced operational costs, increased competitiveness, and enhanced risk management. Banks that embrace instant payments and invest in the necessary infrastructure and technology will be well-positioned to thrive in the digital era and meet their customers' evolving needs. By staying ahead of the curve and offering real-time payment solutions, banks can drive growth, innovation, and success in the dynamic and competitive financial industry landscape.

Upgrade to Next-Gen Payments Technology

The rapid evolution of payment technology demands forward-thinking strategies. Our guide offers detailed insights to help you modernize your systems and keep pace with industry advancements. Prepare for the future—download your guide today!

Learn more about the REN Payments platform here.

Read More About:

Card Issuing

Switching

ATM Management

Payment Platform

Dynamic Currency Conversion

Payment Hub

Real-Time Payments

Comments